We build systematic, data-driven trading technologies.

Who Are We

“Adaptability is the key to survival” – Charles Darwin

At FinLite.ai, we are mathematicians and software engineers who approach markets through quantitative modeling rather than intuition. Founded in 2003, our methodology evolved significantly after the 2008 financial crisis, leading us to prioritize disciplined drawdown control and systematic risk management. By 2010, we transitioned fully to automated trading, and in 2019 we integrated reinforcement learning to enhance adaptability and model precision.

Who Are We

Traditional models often struggle to adjust to changing market dynamics. Reinforcement learning enables continuous adaptation, evaluating new information in real time and adjusting positioning based on evolving market regimes. This approach strengthens our ability to navigate volatility and manage risk consistently across conditions.

Our Vision

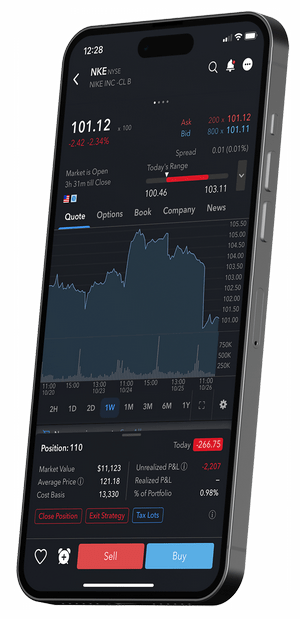

Our proprietary AI-driven strategies were originally developed for institutional use. Today, we make these technologies accessible to a broader audience through a unified platform that supports disciplined execution, model-driven decision-making, and transparent risk control.